Maximize Your HVAC Savings with California Tax Credits & Rebates

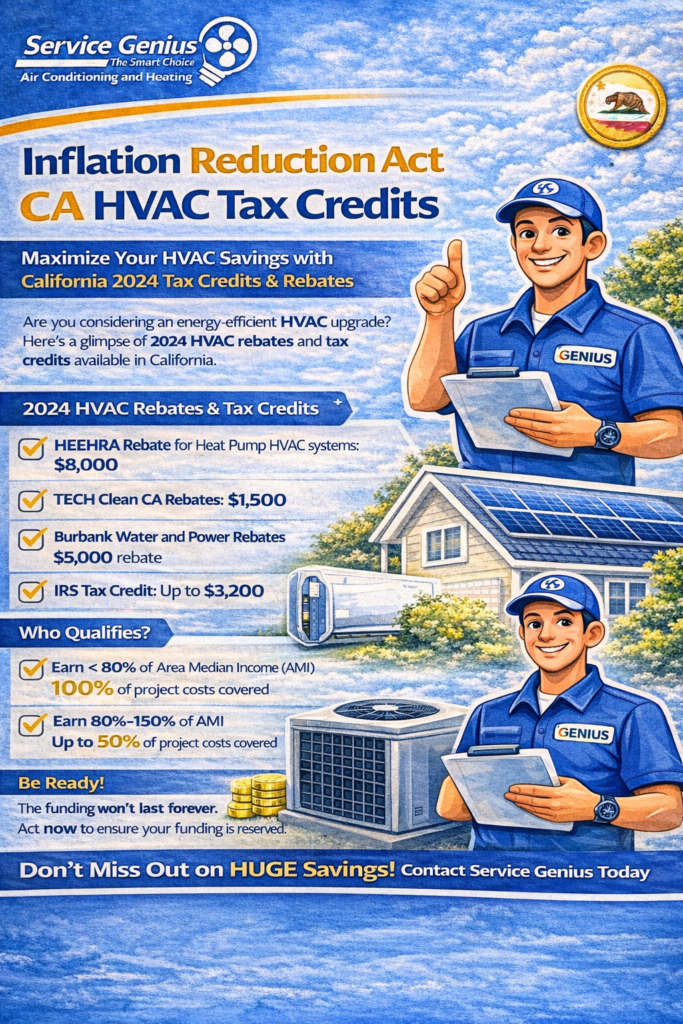

Are you looking to save on an energy-efficient HVAC upgrade in California? Here’s a look at 2024 HVAC rebates and tax credits that can make your project more affordable.

The Inflation Reduction Act of 2022 (IRA) introduced various energy-efficiency incentives, including tax credits and the High-Efficiency Electric Home Rebate Act (HEEHRA). It’s intended to encourage homeowners to invest in energy-efficient upgrades and help in the fight against climate change. The HEEHRA Phase I Program was launched in October 2024 and is available to income-eligible multifamily property owners/operators and single-family homeowners. It provides the first IRA-funded rebates available to qualified applicants.

As part of the 2022 Inflation Reduction Act, the HEEHRA program is decentralized and state-specific. Along with New York and Massachusetts, California has been most proactive initially in recognizing the HEEHRA and its benefits, developing guidelines, establishing an application process, and creating procedures for contractor certification.

Currently, eligible property owners must work with a HEEHRA-trained professional who participates in the Training for Residential Energy Contractors (CA-TREC) program. The Home Efficiency Rebates (HOMES) program is also a part of the IRA and will be available when it launches.

Brief History of the IRA

The IRA, which includes the 10-year HEEHRA rebate program, was passed by Congress and signed into law in 2022 by President Joe Biden. Incentives contained in the $4.5 billion program (nearly $9 billion when combined with the HOMES program) aim to encourage a reduction in carbon emissions by 40% by 2030. The program also encourages investment in domestic energy companies and products.

It is up to the U.S. Department of Energy to make funds available to the states. Once the funds are distributed, state entities set up and administer their rebate programs. Rebates are expected to become available starting in early 2025. California is one of the first states to participate in the program. Under the IRA, it was provided with $290 million for HEEHRA, $291 million for HOMES, and $10 million for TREC.

About the HEEHRA Program

Under this program, those eligible for a rebate will receive it at the point of sale. The maximum rebate amount is $14,000. If you qualify for a rebate, you may receive the following amounts based on the qualifying electrification project:

- HEEHRA Rebate for Heat Pump HVAC systems: $8,000

- TECH Clean CA Rebates for Heat Pumps: $1,500

- TECH Clean CA Rebates for Heat Pump Water Heaters: up to $1,500: $1,500

- Burbank Water and Power Rebates: $5,000 rebate

- LADWP Rebates for Heat Pump HVAC: up to $600

- IRS 25C Tax Credit: $3,200

- Electric Stoves/Cooktops: $840 to $1,200

- Heat Pump Clothes Dryers: $840 to $1,200

- Circuit Breaker Panel: $4,000

- Electrical Wiring: $2,500

- Insulation/Ventilation/Air Sealing: $1,600

Service Genius has partnered with TECH Clean CA to make the qualification process quick and easy. HEEHRA rebates combine with other state and local incentives for MASSIVE savings. Service Genius will handle the rebate process with you and help at each step with our dedicated team of rebate specialists.

Remember, with the changes in Washington, DC, programs like this may not last! ACT NOW to ensure your funding is reserved.

Specific rebate amounts may vary depending on the applicant’s state. The most up-to-date information can be obtained from your state energy office. For customers in our Los Angeles and Chatsworth service areas, this is the California Energy Commission (CEC).

Who Qualifies for an HEEHRA Rebate?

The amount you’re eligible for depends on your household income. Low- and moderate-income (LMI) households are the target of the program. Income thresholds are determined by the Area Median Income (AMI) where you live. Here’s a look at how this breaks down:

- 100% Coverage: Project costs can be fully covered if your household earns less than 80% of the AMI.

- 50% Coverage: You can receive 50% coverage of project costs if your household earns between 80% and 150% of the AMI. This also applies to multifamily buildings with 5+ residential units and 50% or more residents earning LMI.

Rebate amounts are capped at $14,000 regardless of your income. Nonetheless, you can maximize your rebate with the following tips:

- Schedule an Assessment: A qualified HEEHRA contractor should visit your home first for an evaluation. They can recommend the best-suited upgrades that qualify for rebates.

- Compare Your Options: Compare qualifying appliances and models so you can find the most cost-effective options and, best of all, increase your rebate potential.

- Ask Your Contractor for Help: An HEEHRA-certified contractor familiar with rebate requirements can provide you with guidance and also assist with your application.

How Do I Know I Qualify for a Rebate?

The first step is to get prepared. An assessment by an energy auditor can help you make informed decisions on cost-saving electrical upgrades. Knowing the products you want, such as heat pumps, also helps, as demand is expected to increase with more widespread availability of rebates. Waiting for a contractor may take longer as well, so it helps to find a top-rated company for when you’re ready to start an electrical upgrade.

Step-By-Step HEEHRA Rebate Process

The HEEHRA rebate program is ambitious but can be difficult for homeowners to navigate. To make the process less daunting and stressful, here are some basic steps to follow:

- Check Your Eligibility: Check your earnings against your area’s median income, and if the program is available in your area. Learn more at https://www.energy.ca.gov/.

- Locate a Qualified Contractor: A list of contractors certified under the HEEHRA program should be available from your state energy office. Evaluate their reputation by checking online reviews or asking for references.

- Determine If Your Home Is Ready for an Upgrade: Installing a new heat pump or efficient stove may require increasing electrical capacity, improving insulation, and completing other updates. Schedule an assessment by a qualified contractor to determine what needs to be done.

- Learn About Upfront Costs and Financing: Some upfront costs may not be covered or you may have to pay them before the rebate kicks in. Contact your state energy office about available loan programs. Some may be offered through the HEEHRA or you can check with your bank, credit union, home improvement lender, or HVAC contractor about financing options.

- Apply for an IRA Rebate: Once you’ve secured financing, signed a contract, and the project is completed, you can begin the rebate application process. It requires submitting proof of income, receipts, project specifications, and other documentation. Therefore, keep copies of all documents you receive during the project. Your local contractor may assist with your application.

Visit https://techcleanca.com/incentives/heehrarebates/ to learn more about the application process in California, which starts with an eligibility review.

- Receive Your Rebate: The rebate distribution process can vary based on how your state administers the program. Processing applications and reviewing documentation can take time. The payment method can also impact the timeframe. Rebates can be distributed via direct deposit or a paper check. Review state guidelines to estimate the rebate distribution timeline; it can help in planning your home improvement project.

The HOMES Program

When HOMES rebates become available (the CEC applied for funding in August 2024), they’ll be available for single-family homes and multifamily buildings. Qualifying properties must undergo whole-home energy efficiency retrofits. Funding will be split between two different programs. The Equitable Building Decarbonization Direct Install Program provides low-income residents with no-cost upgrades, while the Pay for Performance Program will issue rebates based on measured energy savings (to residents at all income levels).

IRA Tax Credits

The IRA also introduced tax credits that can make energy-efficient home upgrades more affordable. A tax credit is not an instant rebate. Instead, it helps reduce the amount of taxes you owe for the year you installed a qualifying upgrade. The IRA includes opportunities to save money on purchases for the following items:

- Clean Energy: The IRA outlines a range of clean energy solutions that can qualify you for tax breaks. Most of these products are electrically powered.

- Heat Pumps: Heat pumps provide a more efficient way to heat and cool your home than a central HVAC system. Tax credits help reduce the upfront cost to help fit a heat pump into your budget.

- High-Efficiency ACs/Furnaces: You may qualify for tax credits for installing energy-efficient HVAC equipment like air conditioners and furnaces. Many new technologies make these more cost-effective over time.

Benefits of the Tax Credits/Rebates

The Inflation Reduction Act rebates can provide numerous benefits to households that qualify for them, including the following:

- Upfront Savings: With a rebate, qualifying low- to moderate-income households can budget to replace outdated, inefficient appliances. With a new AC or heat pump, less money is spent on costly repairs.

- Lower Energy Bills: It’s possible to save hundreds of dollars per year in energy costs by installing a high-efficiency HVAC unit or a heat pump-operated furnace or water heater.

- Improved Comfort: The electric heating and cooling systems available today provide more precise temperature control than traditional units, improving comfort throughout your home.

- Improved Indoor Air Quality: Modern upgrades move away from gas appliances, reducing indoor air pollution that can trigger or exacerbate respiratory problems.

- Economic Growth: The latest tax credits and rebates can contribute to job creation in the clean energy sector, facilitating economic growth. The increased demand on manufacturers, suppliers, engineers, sales teams, and distributors can help too.

- Reduced Carbon Emissions: Home electrification allows you to take advantage of cleaner power and can reduce your home’s overall greenhouse gas emissions, aiding in the fight against climate change.

- Lower Energy Demand: With more homes using energy-efficient HVAC systems, water heaters, and other appliances, the demand on the energy grid is reduced, which can decrease the demand for fossil fuels.

- Increased Home Value: Energy-efficient upgrades can increase the market value of your home, ultimately leading to a higher selling price.

Frequently Asked Questions

When Will HEEHRA Rebates Be Available in California?

The first stage of the HEEHRA Phase I program was launched in October 2024. Rebates were first available for owners and agents of multifamily buildings, while single-family buildings with up to four units and manufactured and mobile homes are now also eligible. Accessory dwelling units may be eligible as well (continue checking with CEC resources for updates).

Meanwhile, the HEEHRA Phase II Program is expected to launch in late 2025/early 202,6 as is the HOMES Pay for Performance Program. The HOMES Equitable Building Decarbonization Direct Install Program is set to launch in 2025.

Can Contractors Participate in the IRA Residential Rebate Program?

Training for Residential Energy Contractors (CA-TREC) is funded by the IRA through grants. Contractors who install eligible heat pump equipment in a low-income, single-family household receive an incentive of $200.

Can Rebates and Other Incentives Be Combined?

You can combine HEEHRA rebates with other incentives from your local government, utility, or other agency. However, federal rebates must pay for different parts of the project. Other rebates, incentives, and financial assistance can be obtained from various programs including the state-administered GoGreen Home Energy Financing program. Energy Star tax credits are also available. You can learn more about your options on the California Energy Commission website.

Are Rebates Available Retroactively?

You cannot receive a rebate for energy retrofits or upgrades performed before the IRA rebates went into effect. Only projects started after the first part of your application is approved are eligible. To qualify, purchase equipment only after TECH Clean California issues an income verification code.

Who Do I Submit Income Eligibility Proof To?

For your safety, only apply for a HEEHRA rebate via the TECH Clean California website. To protect yourself against fraud, do not provide proof of income or other personally identifiable information to any other source. This includes anyone claiming to represent the California Energy Commission or the State of California.

What If I’m Not Eligible for a Rebate?

If you don’t meet the income requirements for HEEHRA rebates, other federal, state, local, and utility programs are available. You can apply for financial assistance through the Energy Savings Assistance (ESA) Program that covers weatherstripping, insulation, and other weatherization services (must meet California Alternate Rates for Energy (CARE) income limits). Qualifying low-income households can also work with the California Department of Community Services & Development.

Other home energy tax credits are available as well. Check with the Internal Revenue Service for information on these. Loans, equipment leases, and home equity lines of credit can also make a home energy project more affordable.

Conclusion: The Future of the HEEHRA Program

The HEEHRA program primarily targets LMI households more impacted by high energy costs. An upfront rebate provides immediate relief from the financial burden of an electrification project. The program’s simplified application process is intended to encourage broader participation. Whether it will be expanded to reach wider income segments has yet to be seen.

There are potential economic impacts across various sectors. And, with education and outreach on the program, additional financial assistance options, and training programs attracting a diverse workforce, the HEEHRA and other IRA incentives can overcome potential challenges and limitations.

However, one thing is for sure. Options are available now to help you save, so consult with your local HVAC contractor about Inflation Reduction Act tax credits and rebates.

Contact Service Genius Today

At Service Genius, we install energy-efficient air conditioners and heating solutions that save our customers money over time. Programs implemented under the Inflation Reduction Act can provide additional opportunities to save, on top of our maintenance plans, coupons, and financing options, including loans. High-efficiency ACs, furnaces, heat pumps, and water heaters can be affordable.

For more details on IRA tax credits and rebates or to request same-day or 24/7 service, contact Service Genius today.

On

On